- Federal Reserve's monetary policy decision is expected to reinforce the perception that US interest rates will remain higher for longer, contributing to the strengthening of the dollar.

- The projection of a slowdown in PMI in China is expected to reinforce the perception of a loss of economic dynamism in the country, harming the performance of risky assets such as commodities and currencies of countries that export primary products, like the Brazilian real.

- Disclosure of the first quarter's GDP and a preview of April's inflation for the Eurozone are expected to increase expectations of interest rate cuts by the ECB in June. This, in turn, worsens the continent's interest rate differential versus the USA and contributes to the weakening of the euro against the dollar.

- Expectation of a slowdown in job creation in the US may reduce fears of an overheated economy and partially recover bets on interest rate cuts by the Fed in 2024, weakening the USD.

The week in review

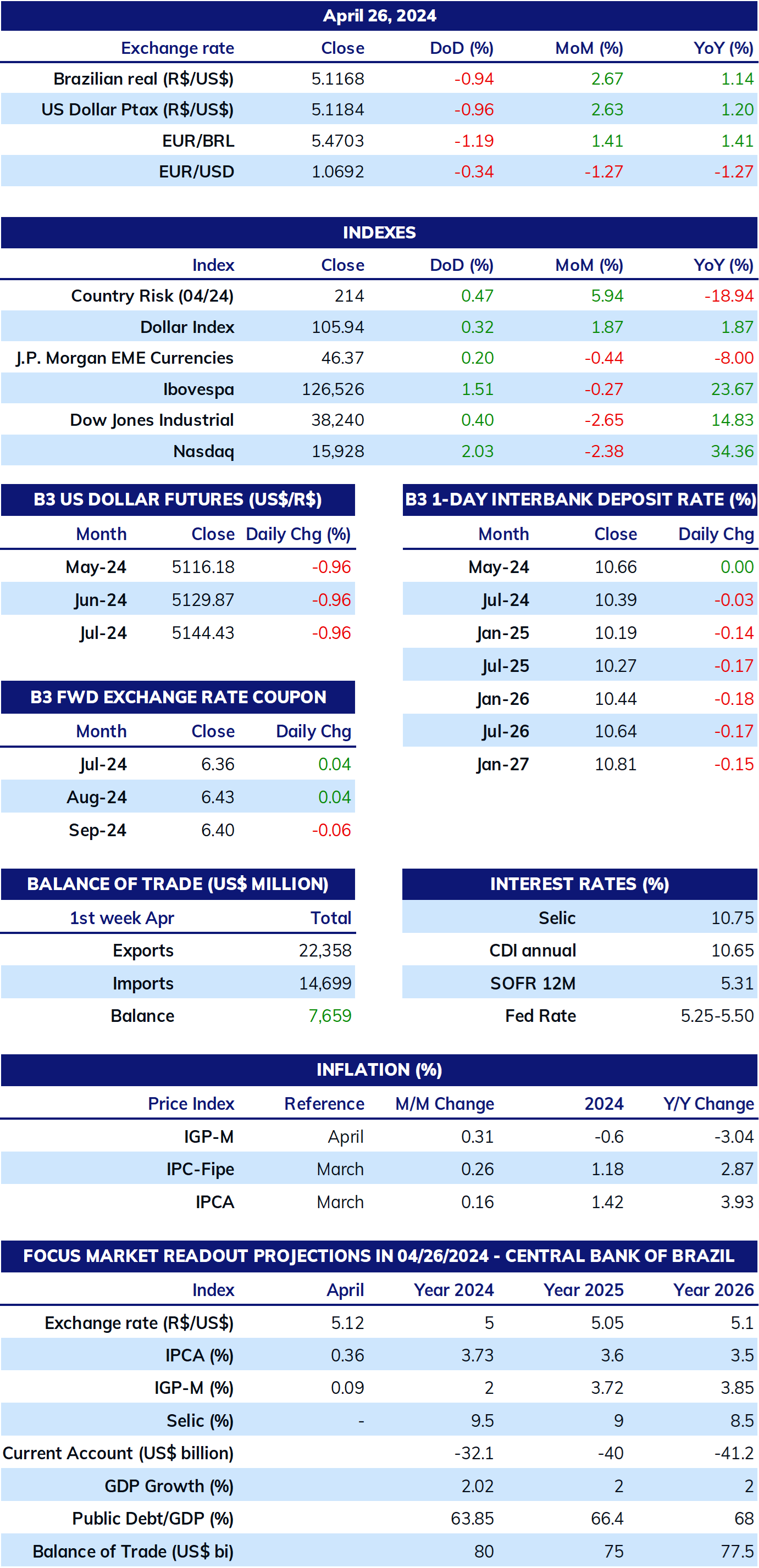

The week was marked by the prospect of more cautious behavior by the Central Banks of Brazil and the USA amidst warmer American inflation data and a revision of investors' expectations for the basic interest rate (SELIC).

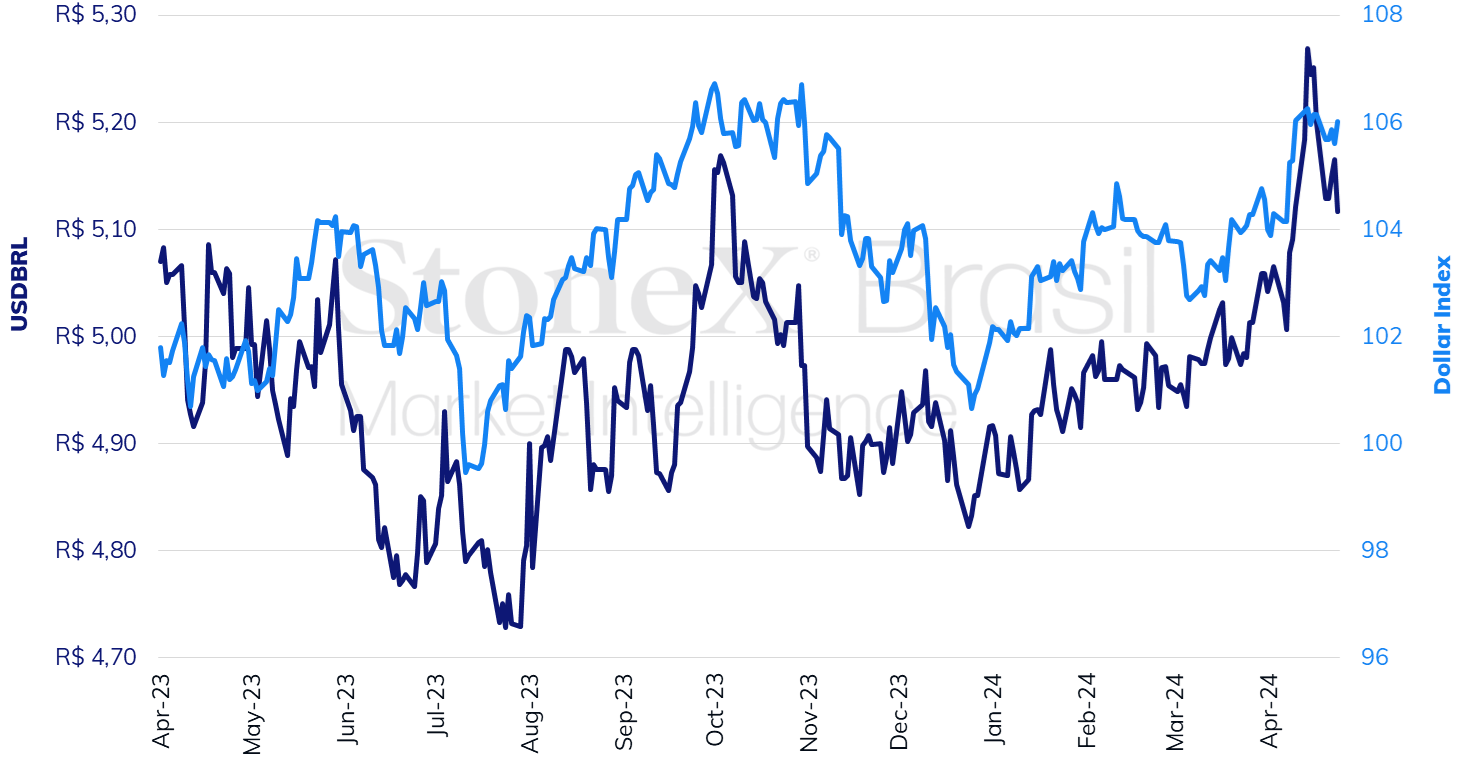

The USDBRL ended the week lower, closing Friday's session (26) at BRL 5.117, a weekly decrease of 1.6%, but a monthly gain of 2.9% and an annual gain of 5.5%. The dollar index closed Friday's session at 106.0 points, a change of -0.1% for the week, +1.8% for the month, and +4.9% for the year.

THE MOST IMPORTANT EVENT: FOMC interest rate decision

Expected impact on USDBRL: bullish

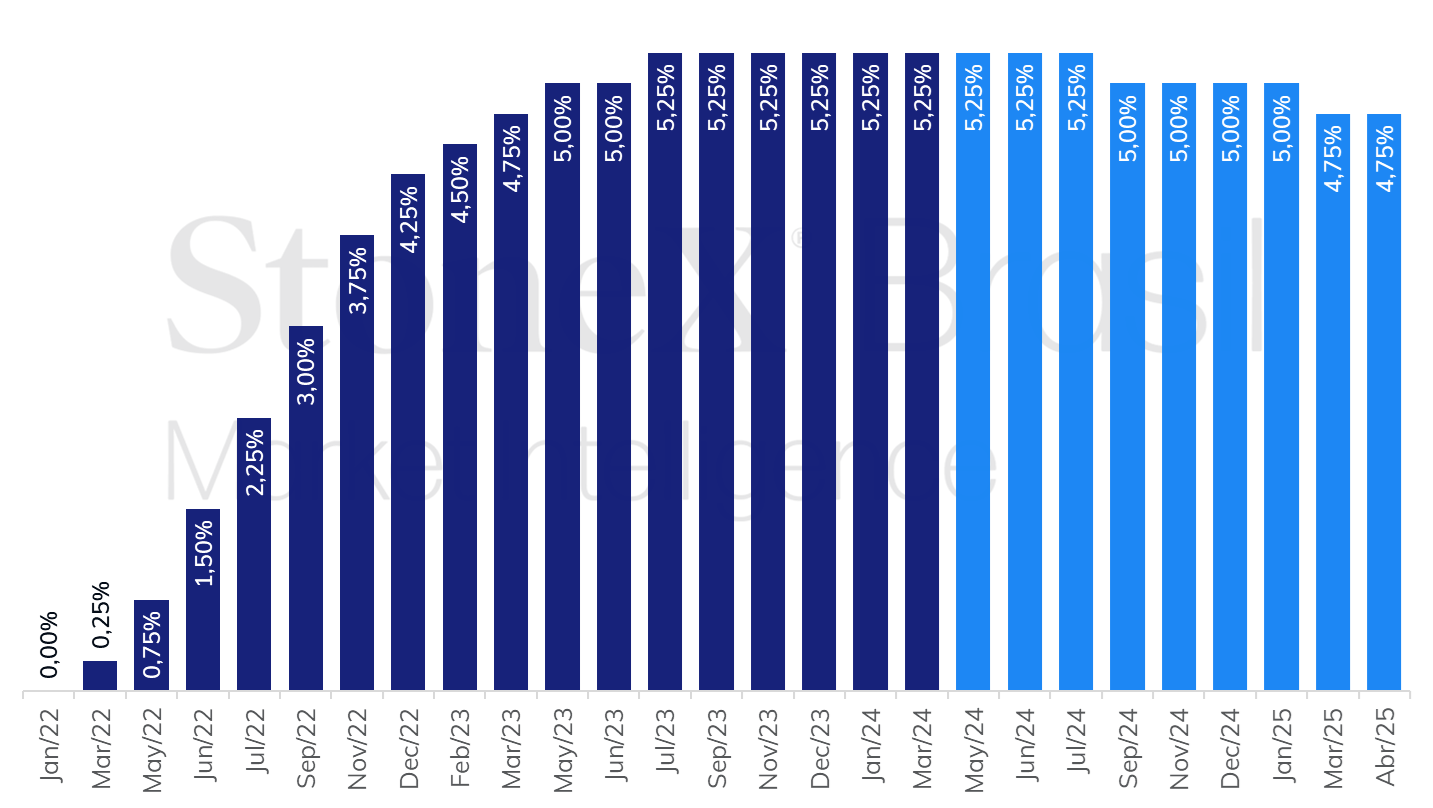

There is a high consensus on the monetary policy decision of the Federal Open Market Committee (FOMC) of the Federal Reserve (Fed), which is expected to keep the US basic interest rate unchanged between the range of 5.25% to 5.50% per year. After warmer data for American inflation in the first months of the year, the statement of the decision and the press conference of Fed Chair Jerome Powell should be more cautious in their outlook for interest rate cuts by the Fed, repeating the message that the Committee hopes that inflation would return to the 2% target per year, but that recent data "do not increase" the FOMC's confidence that this stabilization can occur quickly. Thus, the interpretation that it will take at least a few more months to verify whether inflation moderation is occurring satisfactorily should be reinforced, which should reduce the Fed's expectations for interest rate cuts this year.

US: History and expectation for the interest rate - April 26, 2024

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest likelihood in the future interest rate market on the indicated date.

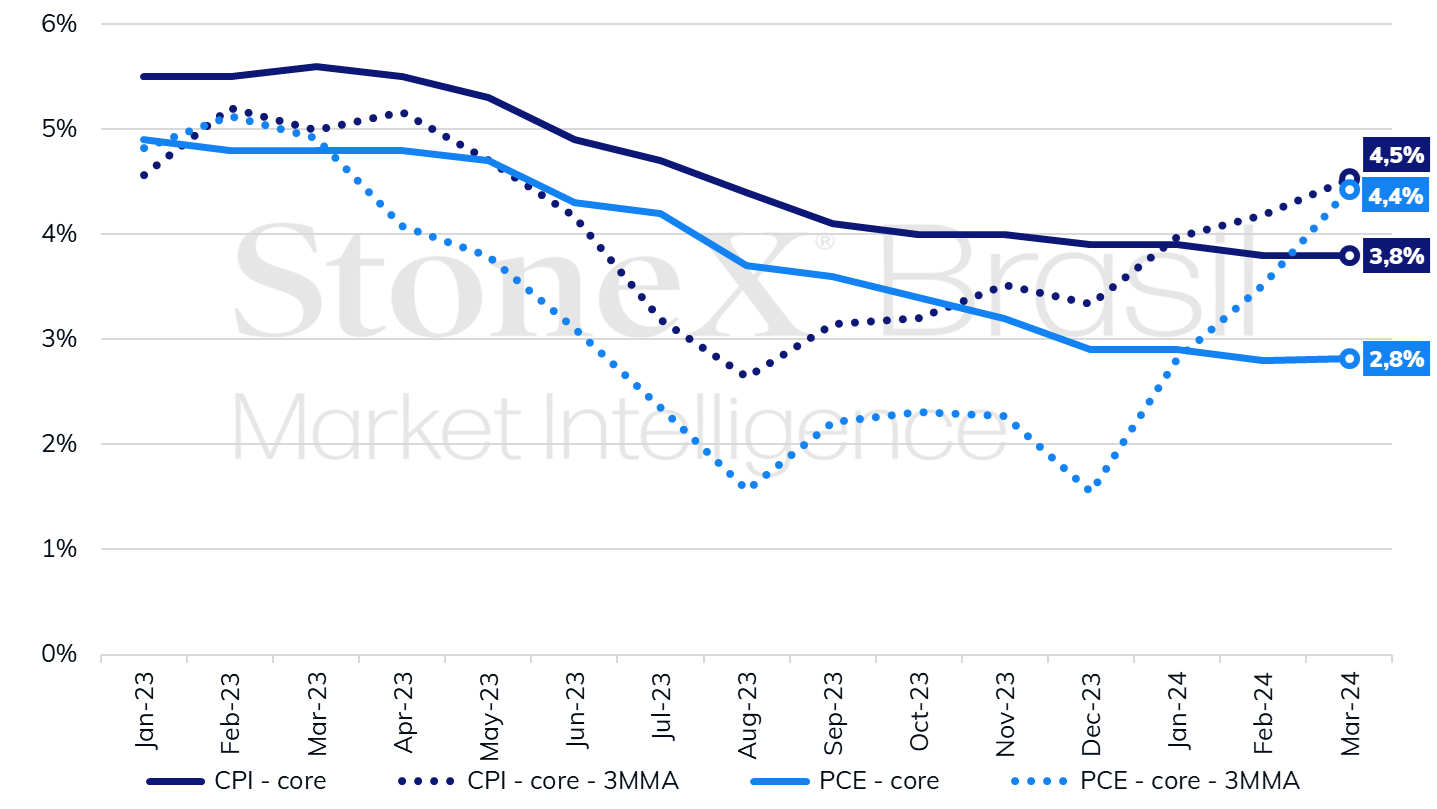

Indeed, the annualized average of the last three months for both the core (which excludes the volatile categories of food and energy) of the Consumer Price Index (CPI) and for the Personal Consumption Expenditures (PCE) Index are above 4%, reinforcing that there are reasons for caution from the Fed in evaluating inflation moderation and drastically reducing investors' bets on the monetary easing process in the US, with most bets in the futures market pointing to a rate cut only in September, followed by another in March 2025.

Inflation measures for the United States (accumulated in 12 months)

Source: Federal Reserve Bank of St. Louis. Design: StoneX.

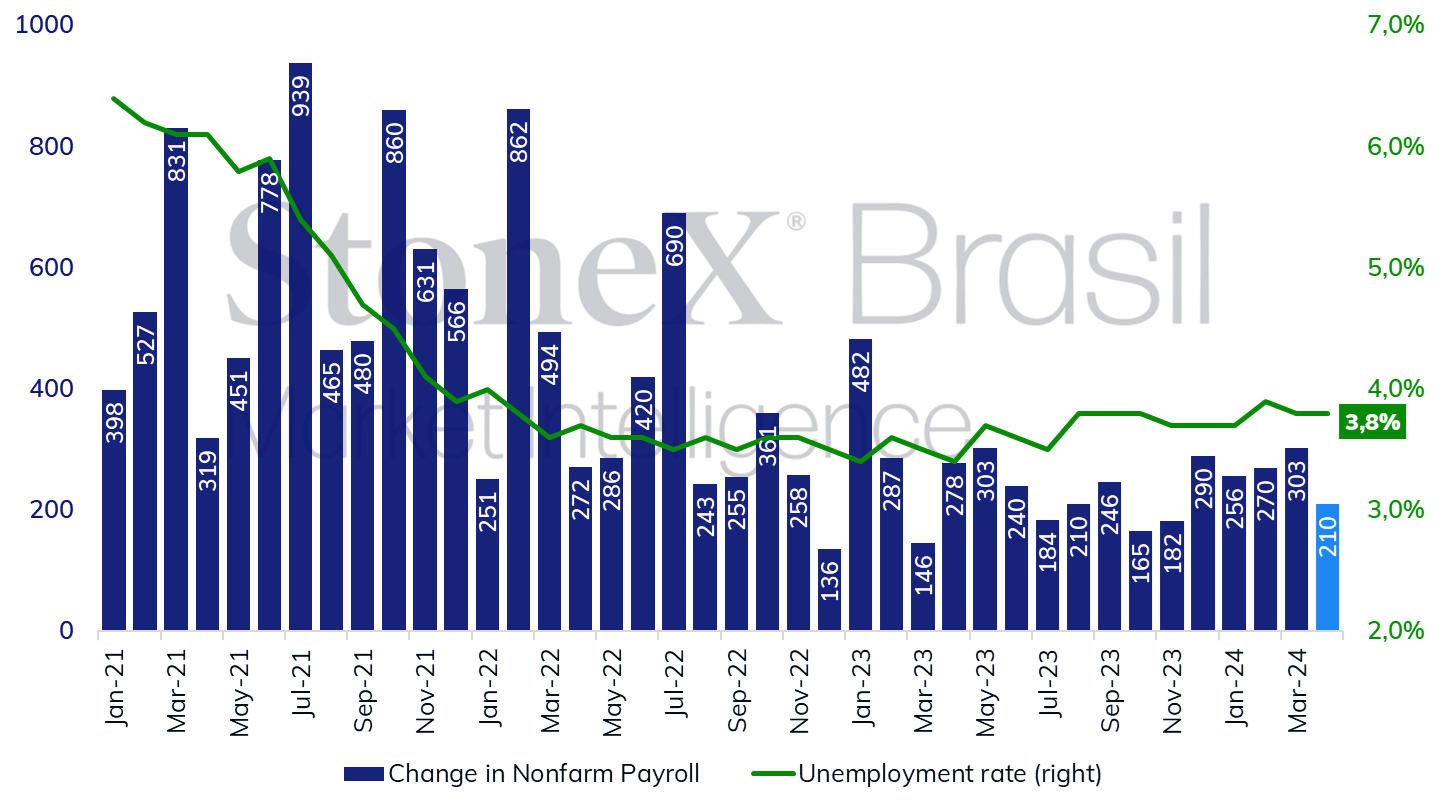

US Payroll

Expected impact on USDBRL: bearish

The median estimate for the balance of new job creation in the United States points to 210 thousand new jobs, which would represent a slowdown for the indicator compared to the average of 280 thousand jobs in the last four months; however, the 40th consecutive month of increase in the employment level. The lower estimates result from readings below expectations for economic activity indicators, such as the Purchasing Managers' Index (PMI) and the first quarter's Gross Domestic Product (GDP). However, it is important to highlight that the American job market has surprised analysts with its resilience and high demand for labor in recent months, and there are risks of another reading above the estimates. While a slowdown versus previous months could contribute to raising expectations of interest rate cuts by the Federal Reserve in 2024, a figure above expectations could consolidate the perception that there should not be any interest rate reductions by the Fed before September.

Variation in total urban employment in the United States (in thousand people) and unemployment rate (%)

Source: Federal Reserve Bank of St. Louis. Design: StoneX.

PMI in China

Expected impact on USDBRL: bullish

This week, the release of the April Chinese Purchasing Managers' Index (PMI) is expected to reinforce the perception that the country's economy is losing momentum. This, in turn, is likely to harm the performance of risky assets such as commodities and currencies of countries that export primary products, like the Brazilian real. A slowdown is expected for both the industrial and services PMI measured by the National Bureau of Statistics of China (NBS) on Monday (29), and a slight decrease in the industrial PMI (Monday, 29) and services (Sunday, 05) measured by S&P Global/Caixin.

European economic data

Expected impact on USDBRL: bullish

This week, the first preview for the euro zone's GDP is expected to show that the unified currency bloc remains very close to stagnation, with an increase of only 0.1% in the first quarter of 2024 after remaining stable (0%) in the last quarter of 2023. Additionally, the preview for April inflation should show that consumer prices continue to moderate, especially in its core, going from a 12-month accumulated increase of 2.9% in March to around 2.6% in April. Both data should reinforce the perception that the European Central Bank should make its first interest rate cut in June, as there is room for easing both from the standpoint of inflation moderation and the dismal economic performance. This, in turn, would worsen the interest rate differential of the continent versus the US, which should contribute to the weakening of the euro against the dollar.

End-of-month PTAX rate

Expected impact on USDBRL: undefined

After months of low volatility, the real/dollar pair showed sharp fluctuations in April. On Tuesday (30), the volume of trades and volatility are expected to be higher within the time windows used by the Central Bank of Brazil to calculate the end-of-month PTAX rate. The PTAX rate is a reference published daily by the Central Bank, and its end-of-month value is widely used in foreign exchange and derivatives contracts. As a result, traders intensify their operations during these intervals, vying for its determination.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.