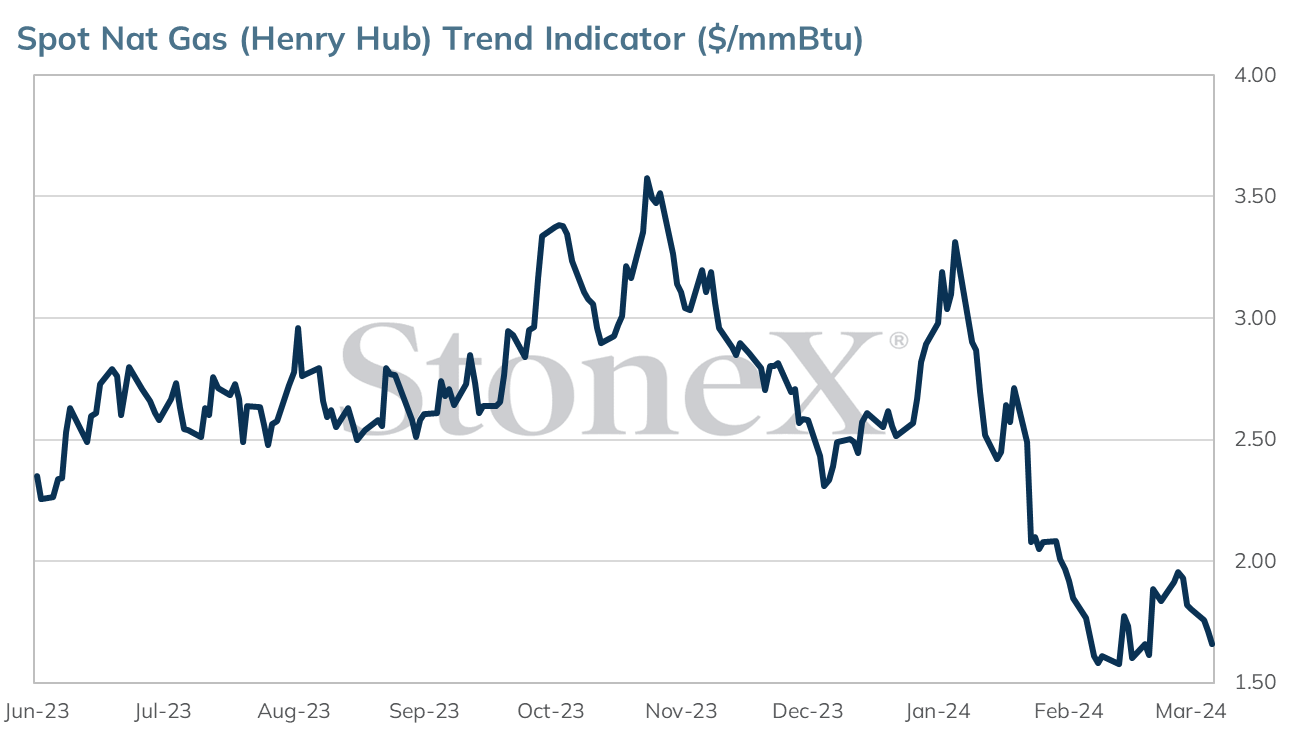

Natural gas settled lower for a 6th straight session yesterday amid a drop in consumption due to mild weather and reduced LNG feedgas. Expectations another widening of the storage surplus also weighed on prices. Apr futures closed 5.6 cents lower at $1.658.

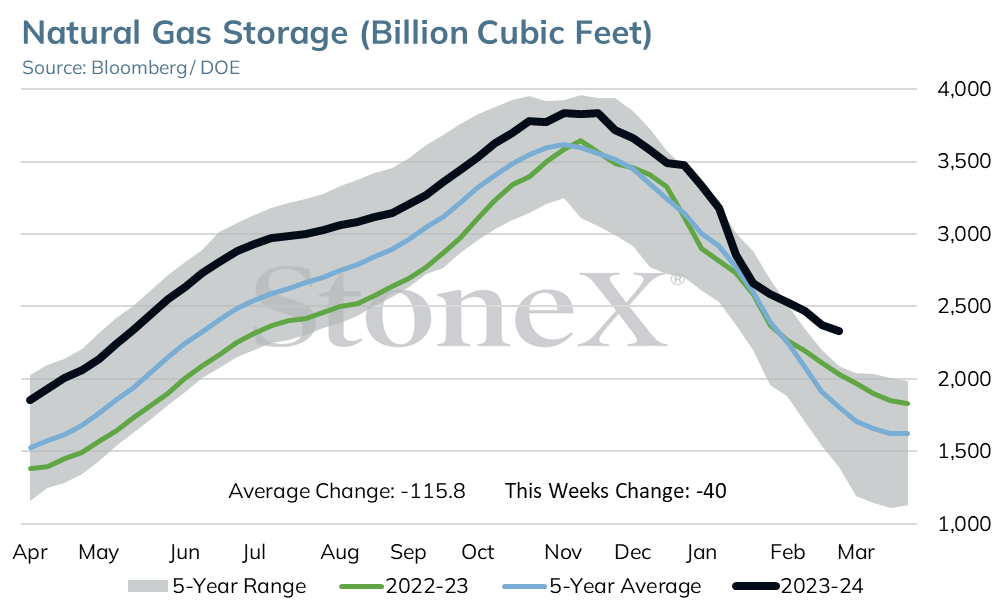

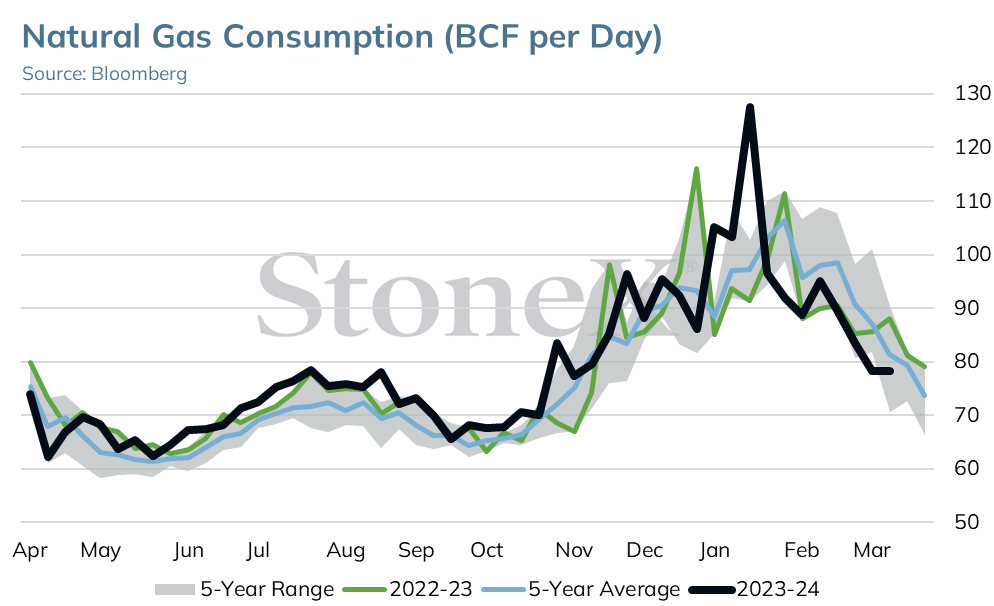

The average rate of storage withdrawals this year has been 20% lower than the 5 yr avg. A much lower than normal draw is expected in today’s storage report. The EIA is likely to show a 3 BCF pull from storage for the week ended Mar 8. This compares to last year’s draw of 65 BCF and the 5 yr avg draw of 87 BCF.

Early estimates for next week’s report range from a draw of 11 BCF to an early season build of 9 BCF. Extremely mild temps last week diminished heating demand to levels more typical of late April. Over the next 2 reports, the storage surplus could potentially surge by more than 125 BCF.

More springlike temps this week have suppressed demand even further. Total demand yesterday plunged to 97.4 BCF/day as res/comm usage fell to just just 21.1 BCF/day. Weather driven demand will rise heading into the weekend as colder air settles in. Res/comm usage will average 28.3 BCF/day over the next week before easing slightly to 27.4 BCF/day during the 8-14 day period. Total demand is forecast to average 107.3 BCF/day over the next week before easing slightly to 106.1 BCF/day during the 8-14 day average.

After trading little changed earlier this morning, prices are currently a few cents higher on the day.

The April 24 natural gas contract has closed down six consecutive sessions dropping from a 2.009 high reached Tuesday of last week to a 1.658 settle on Wednesday.

The April contract has broken under the 38%, 50%, and 61.8% retracement support levels of the February-March uptrend on recent weakness turning the 78% retracement at 1.620 and the final 88% retracement at 1.570 into the next areas of support.

If 1.570 support is broken, the 1.511 February low will become the next area of support. If 1.511 or above support can hold, a post-winter low will be in place.

If 1.511 support is broken, the June 2020 low at 1.432 will become the next area of support.

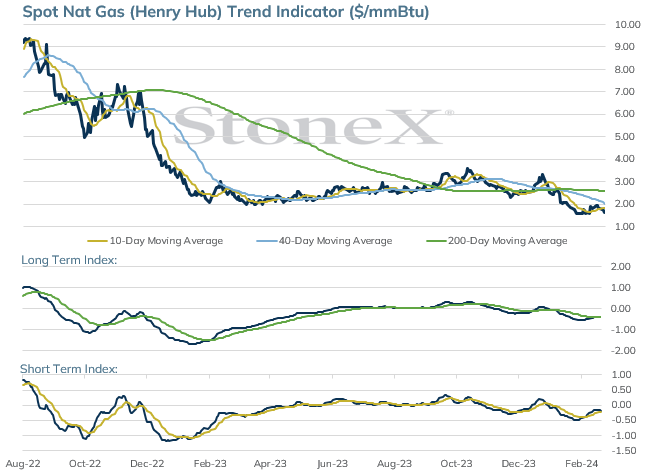

Moving Average Alignment – Bearish

Long Term Trend Following Index – Bullish

Short Term Trend Follow Following Index - Bullish

Relative Strength Index - 37.73

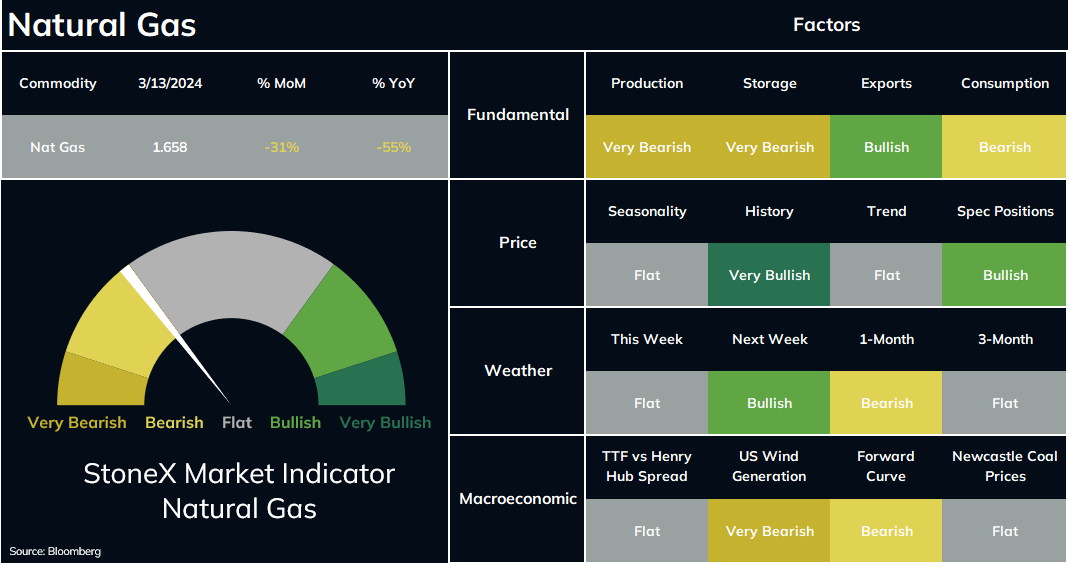

The StoneX Market Indicator provides an overall view of market sentiment for a commodity based on the quantification of fundamental, technical and historical market data related to that commodity. Each factor is quantified by comparing data for the current period versus last year, versus the previous period, versus its history and versus the yearly average. This quantification is converted to a number and summed together. The sum of all factors are reweighted by the 4-year decile of its history. The 4-year deciles redistribute the StoneX Market Indicator to obtain an equal share between the bullish and the bearish signals. The StoneX Market Indicator History graphically represents each day’s actual very bearish to very bullish signal. This history contains the sum of all factors, excluding weather forecasts.

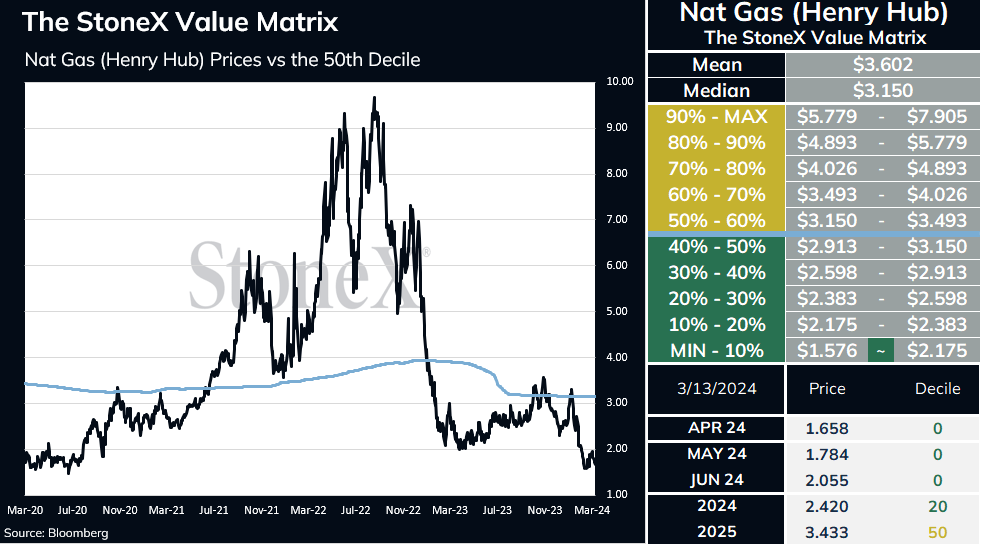

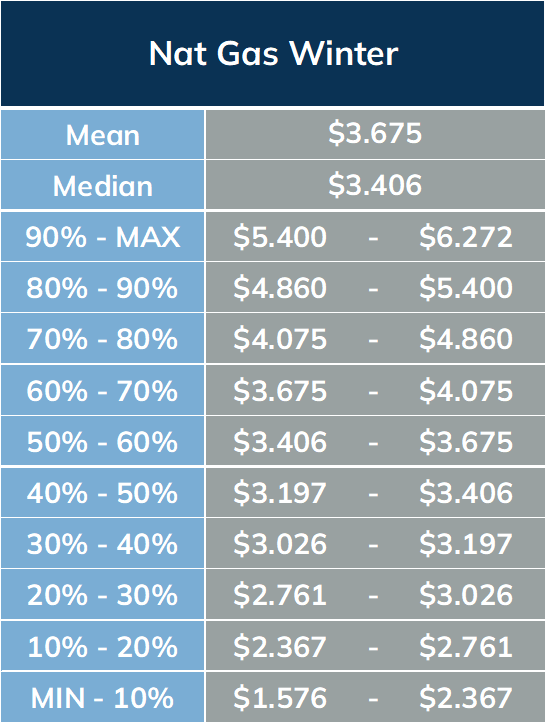

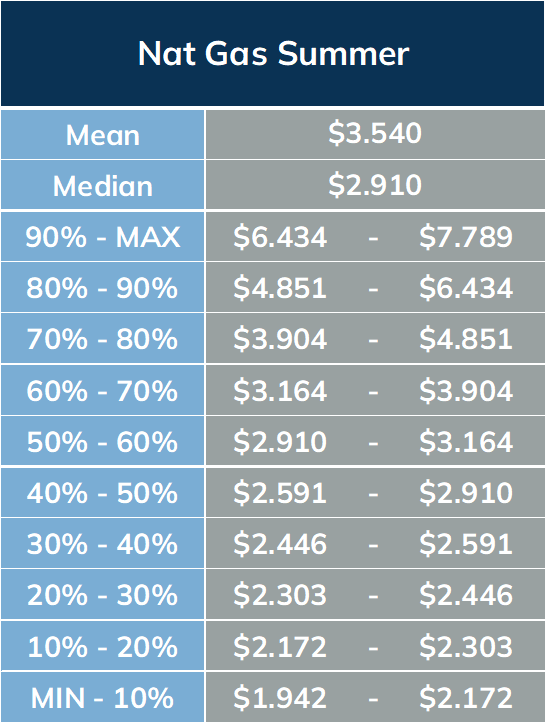

The StoneX Value Matrix provides a measure of historical value by analyzing 4 years historical price data distributed into 10 deciles. All of the years are weighted at 20% with the exception of the most recent year which is weighted at 40%. The prices are adjusted for inflation using the Producer Price Index (PPI).

Reproduction or use in any format without authorization is forbidden. © Copyright 2024. All rights reserved.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.