Global precious metals solutions

Access a full suite of precious metals trading services, including OTC spot/forwards, swaps, options, margin trading, benchmark pricing, API solutions, clearing and custody, financing, loco swaps, gold, silver, platinum and palladium futures trading, EFPs, vaulting, storage and consignment.

Explore our precious metals services

-

Physical tradingWe offer a comprehensive range of physical trading capabilities and provide financing, warehousing and deliveries for gold, silver and platinum group metals.

Physical tradingWe offer a comprehensive range of physical trading capabilities and provide financing, warehousing and deliveries for gold, silver and platinum group metals. -

Financial tradingWe offer a range of financial trading solutions for precious metals clients including spot trading, forward contracts, location swaps, options, leases, hedging structures and more.

Financial tradingWe offer a range of financial trading solutions for precious metals clients including spot trading, forward contracts, location swaps, options, leases, hedging structures and more. -

Clearing and custodyOur comprehensive suite of institutional-grade clearing and custody services delivers broad exchange access and transparency to precious metals clients worldwide.

Clearing and custodyOur comprehensive suite of institutional-grade clearing and custody services delivers broad exchange access and transparency to precious metals clients worldwide. -

Vaulting and storageWe offer secure, competitively priced global vaulting and storage solutions in gold, silver and platinum group metals for our clients.

Vaulting and storageWe offer secure, competitively priced global vaulting and storage solutions in gold, silver and platinum group metals for our clients. -

StoneX BullionBuy, sell, and invest in high-quality and sought-after coins and bullion bars, with products in silver, gold, platinum, and palladium.

StoneX BullionBuy, sell, and invest in high-quality and sought-after coins and bullion bars, with products in silver, gold, platinum, and palladium. -

PMXecute®Experience real-time foreign exchange pricing, global liquidity, and exceptional client support all in one powerful precious metals trading platform.

PMXecute®Experience real-time foreign exchange pricing, global liquidity, and exceptional client support all in one powerful precious metals trading platform.

Discover opportunity with StoneX Precious Metals

Gold

Silver

Platinum group metals

Explore our innovative service offerings

-

Trading

Clients can access markets through high-touch trading and advisory services and our convenient electronic trading platform. We provide follow-the-sun order services from the Asia open to the New York close, along with flexible API solutions that offer executable OTC and physical pricing for our clients’ own trading systems and web-shops. StoneX also delivers reliable flow execution across commodities derivatives through our sales and trading solutions.

-

Execution

We leverage StoneX’s global operations, logistics and IT infrastructure capabilities to provide seamless execution – including financing, warehousing and deliveries for physical transactions across the globe.

-

Payments

We offer customized foreign exchange and payments services in more than 140 local currencies, highly competitive rates, seamless access to our electronic platform along with 24-hour service from dedicated staff across the globe.

Elevate your precious metals trading with StoneX

Our physical trading capabilities

- Bullion bars such as LBMA and non-LBMA large bars, kilo bars, 100 grams, tola bars

- Bullion coins and collectible products

- Semi-refined products and doré

- Scrap

- Off-take arrangements

Our financial trading capabilities

- Spot trading in multiple currencies

- Margin trading facilities

- Forward contracts

- Option instruments

- Location swaps (multiple)

- Leases

- Consignment accounts

- Hedging structures

- Ability to price and make payments in foreign currencies

- Futures clearing and execution

- API trading

PMXecute® trading platform

Experience real-time competitive pricing in both precious metals and foreign exchange on a simple, reliable, intuitive and secure trading platform. Backed by StoneX’s global team of metals professionals, we provide global access to liquidity across all time zones and unparalleled client support.

- Real-time competitive pricing in both precious metals and foreign exchange

- Easy-to-access live position analytics and margin monitoring

- Online order functionality

- Real-time order viewing and tracking

- Seamless execution

- London gold, silver, platinum and palladium auction orders

- Price feed available via our suite of flexible API solutions

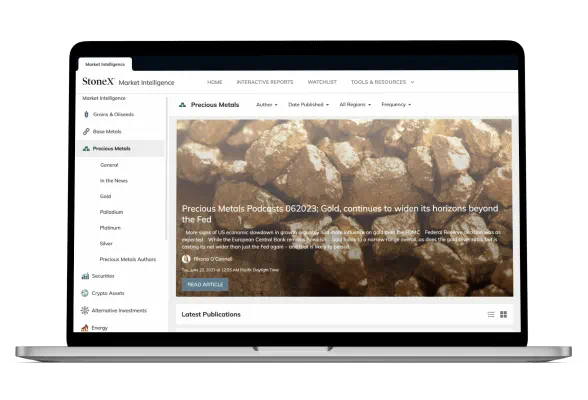

Access award-winning Market Intelligence

Precious metals vaulting & storage solutions

StoneX offers its clients secure global vaulting and storage solutions. We provide fully segregated holdings of gold, silver and platinum group metals held in high-security vaults at various locations across the globe.

Choosing a StoneX precious metals depository means your assets are secure, fully insured and independently audited. Our experienced global team can provide you with exceptional coverage and service.

Our services include:

- Access to many brands, bars, and coins

- Global storage services customized to meet your needs

- Competitively priced solutions

Who we serve

We work with all types of clients in the metals industry and clients with exposure to the market, including:

- Bullion wholesalers & traders

- Refiners & smelters

- Banks & financial institutions

- Equipment manufacturers

- Mining companies

- Pharmaceutical & industrial users

- Oil & gas

- Electronics

- Recyclers

- Transportation

- Wholesalers & retailers

- Investors

Why choose precious metals services at StoneX?

We earn our clients' business and trust by offering expertise, extensive product coverage, global reach and access to markets that few other firms can match. Our "boots on the ground" mentality emphasizes the importance of local connections within the markets, putting us at the forefront of precious metal investment companies.

At StoneX, we take an entrepreneurial, flexible, and agile approach to providing real-time solutions to our clients in the gold, silver, platinum and palladium markets. Our comprehensive precious metals services include financial trading such as gold and silver contracts, as well as physical trading and access to our advanced institutional-grade precious metals trading platform (PMXecute). We provide tailored solutions for your business such as futures contracts, clearing and custody, OTC spot/forwards, margin trading, precious metals consultation services, storage and more.

Contact us today to learn more about how we can help meet your business goals in the dynamic precious metals markets.

Our clients

The Precious Metals Team at StoneX is focused on providing tangible results for our clients worldwide across the entire precious metals supply chain.

Refiners and smelters

Banks and financial institutions

Mining companies

Our global reach opens markets

StoneX Group Inc. connects clients with the global markets across all asset classes – providing execution, post-trade settlement, clearing and custody services through one trusted partner. A publicly traded company (NASDAQ: SNEX) headquartered in New York City, StoneX and its 3,600+ employees serve more than 54,000 commercial, institutional and payments clients, along with 400,000+ retail customers from more than 80 offices across six continents.

FAQ

Should I invest in precious metals?

Investing in precious metals can be a prudent financial strategy, providing a diverse range of options for those looking to safeguard their assets and hedge against inflation. As a reputable gold and silver trading company, we offer a platform for individuals to conveniently buy and sell precious metals online. Our expertise extends to various aspects of precious metals trading, including gold contract futures, silver contracts, and gold futures.

For those seeking secure storage solutions, our precious metal vault and storage facilities ensure the utmost protection for physical precious metals. As a trusted name among precious metal storage companies, we prioritize the safety and integrity of your investments. Additionally, our precious metals brokerage group specializes in connecting clients with opportunities to trade precious metals, offering services such as precious metals brokerage and clearing.

Investors can explore the benefits of precious metals investment funds and exchange-traded funds (ETFs) focused on gold and other precious metals. These investment vehicles provide flexibility and accessibility to a diversified portfolio.

Whether you are interested in metal ETFs, futures contracts, or physical gold, our comprehensive services cover a spectrum of metal investments.

How do I invest in precious metals?

Gold futures are contracts that allow investors to speculate on the future price of gold. These contracts are traded on a commodities exchange and are a popular way for traders to gain exposure to the precious metals market. If you are interested in trading precious metals, get in contact with our team today.

What are precious metals?

Precious Metals talking points 042224: Weekly round-up for StoneX Bullion;

Monday 2:40 PM

Precious Metals talking points 042224: Weekly round-up for StoneX Bullion;

Monday 2:40 PM

Precious Metals London Weekly Front Desk Presentation 041724 - big one this time

Wed, Apr 17, 2024 at 02:45 PM UTC

Precious Metals London Weekly Front Desk Presentation 041724 - big one this time

Wed, Apr 17, 2024 at 02:45 PM UTC

Precious Metals talking points 041624: Collaboration with the Strategy Team on Gold and the Gold Miners

Tue, Apr 16, 2024 at 03:10 PM UTC

Precious Metals talking points 041624: Collaboration with the Strategy Team on Gold and the Gold Miners

Tue, Apr 16, 2024 at 03:10 PM UTC

StoneX: We open markets

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 36+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

If you're an existing customer, please direct any inquiries to your StoneX sales team.

StoneX Financial Ltd is authorized and regulated by the Financial Conduct Authority and is a Category 1 Ring Dealing Member of the London Metal Exchange. The FCM Division of StoneX Financial Inc. acts in the capacity of an agent in the U.S. for StoneX Financial Ltd. Commodity trading involves risks, and you should fully understand these risks before trading. This information shall not constitute a solicitation to buy or sell futures or options contracts, or OTC products. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Through the FCM Division of StoneX Financial Inc., a clearing member of the Commodity Exchange (COMEX) and the New York Mercantile Exchange (NYMEX), the Metals Team provides comprehensive futures and options on these exchanges. OTC swaps are also available on these products through StoneX Markets LLC. Through our membership on the Chicago Mercantile Exchange (CME), our clients can access its full product slate including the plastics, NGL, and olefins contracts.

The FCM Division of StoneX Financial Inc. is a Futures Commission Merchant registered with the Commodities Futures Trading Commission ("CFTC").

The trading of commodities and derivatives such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Advisory services as well as the trading of futures and options is available through various subsidiaries of StoneX Group Inc. including but not limited to the FCM Division of INTL FCStone Financial Inc. Public Disclosures for the FCM Division of INTL FCStone Financial Inc. The trading of over-the-counter products or swaps is available through subsidiary stoneX Markets LLC to individuals or firms who qualify under CFTC rules as an eligible contract participant. Please click here for the full disclaimer.

StoneX APAC Pte. Ltd. (“SAP”) (Co. Reg. No 200616676W) is regulated as a Dealer (PS20190001002) under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism. SAP is an “Approved International Trading Company” authorized to act as a “Spot Commodity Broker” under the Commodity Trading Act.