- Powell's testimonials to the American Congress should reinforce the perception of cautious behavior from the Federal Reserve in 2024, consolidating bets for interest rate cuts starting in June and strengthening the USD.

- European Central Bank must adopt a cautious stance on the evolution of inflation in the eurozone, which may decrease appetite for risky assets and weaken the BRL.

- Employment and service activity data in the USA are expected to decrease slightly compared to January, easing the perception that the US economy is overheated and contributing to a global weakening of the USD.

- Data for the Chinese economy may show a rebound in the country and increase investors' appetite for risky assets, such as commodities and currencies of emerging countries, strengthening the BRL.

The week in review

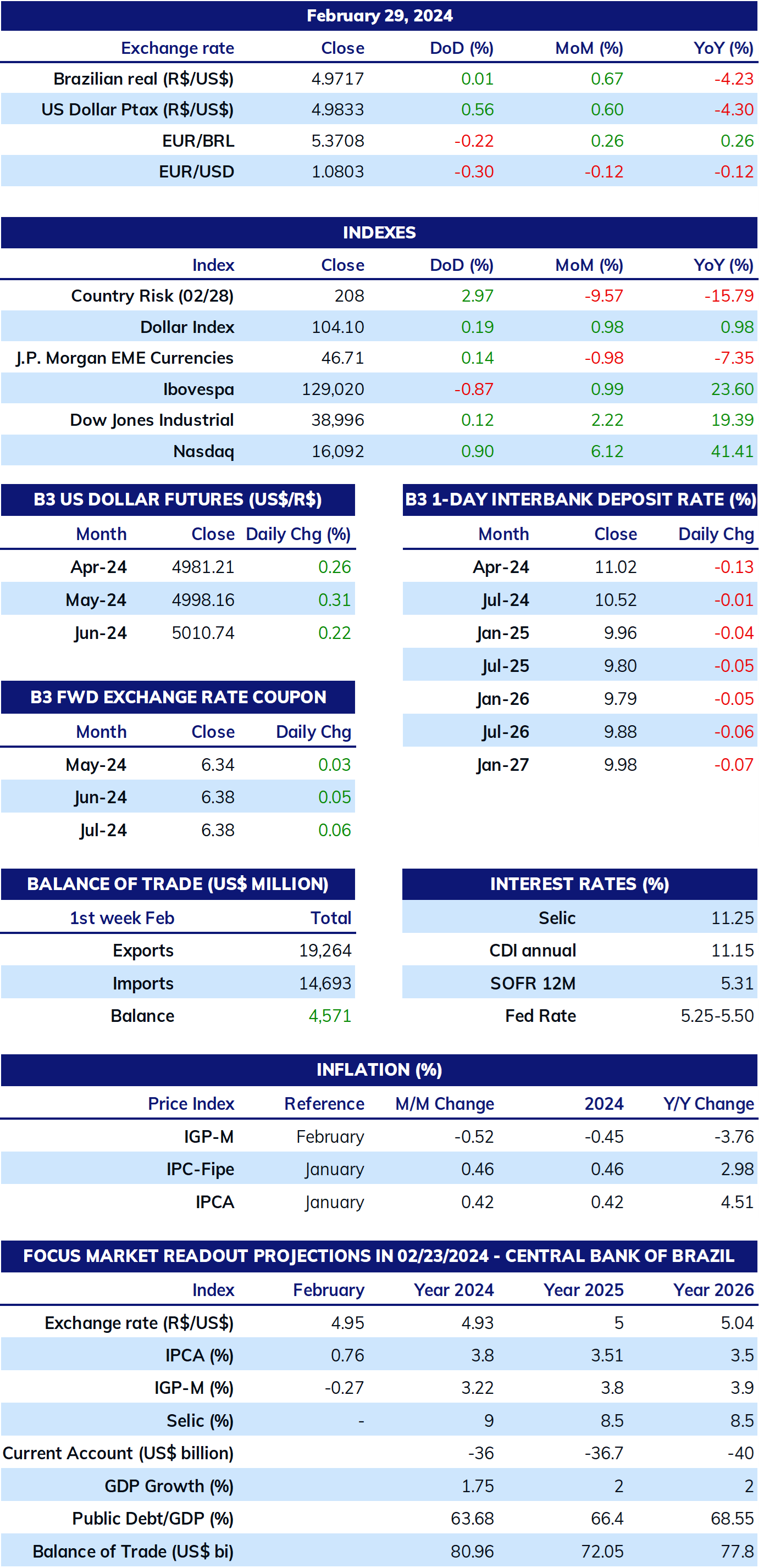

The week was marked by the release of inflation data for Brazil and the US and the release of the stable Brazilian fourth quarter Gross Domestic Product. The data reinforced a perception that interest rates in the US should remain flat for a few more months while the Monetary Policy Committee (COPOM) should maintain its pace of cuts for the basic interest rate (SELIC).

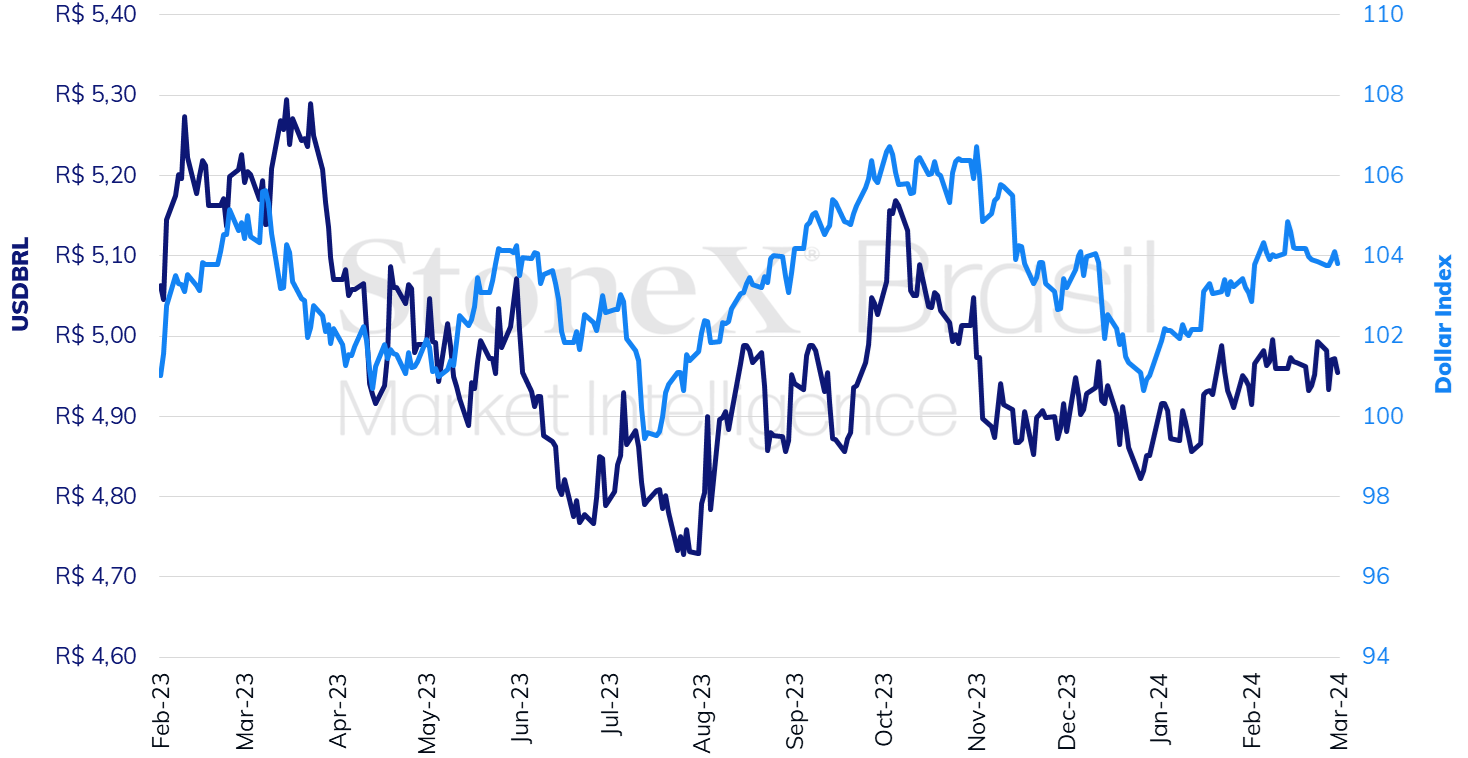

The USDBRL ended the week lower, closing Friday's session (01) at BRL 4.955, a weekly decline of 0.8%, a monthly decline of 0.3%, and an annual increase of 2.1%. The dollar index closed Friday's session at 103.8 points, a change of 0.0% for the week, -0.3% for the month, and +2.8% for the year.

THE MOST IMPORTANT EVENT: American economy data

Expected impact on USDBRL: bearish

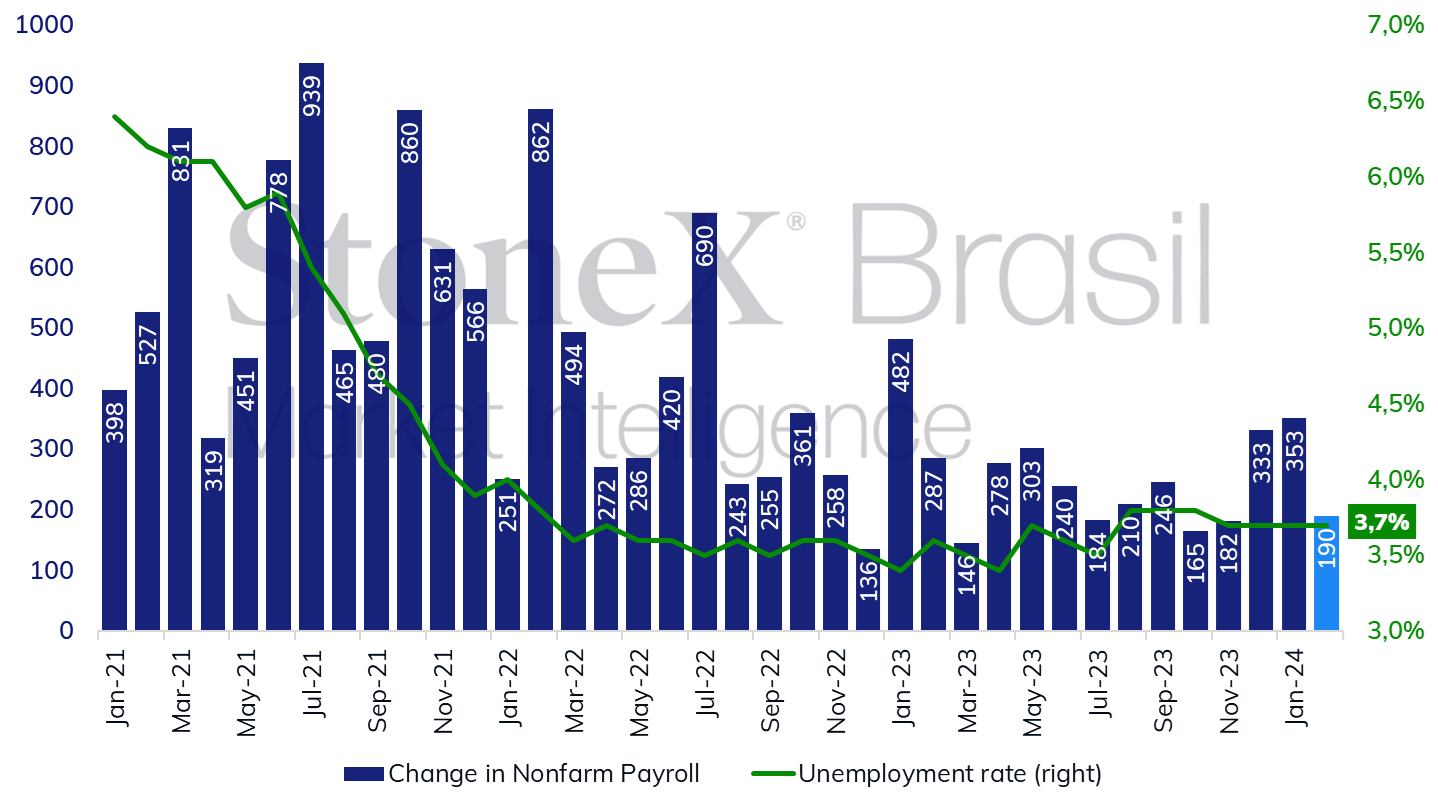

Investors' attention should focus on the release of data for the labor market and service activity in the USA. The median of estimates for the Employment Situation Report for February points to a net generation of 190 thousand jobs in the month, below the average of 289 thousand jobs in the last three months, but still a healthy pace of expansion, and that would still suggest a labor market with high demand for workers. The figure for weekly unemployment claims also remains nearly flat, with around 200 thousand weekly claims, indicating that a sudden weakening of the labor market is unlikely. The Purchasing Managers' Index (PMI) for services is expected to slightly lessen its pace of expansion, dropping from 53.4 points in January to 52.5 points in February. These projections, if confirmed, would show a gentle slowdown of the American economy in tandem with an interpretation of a "soft landing." Nonetheless, after two months of stronger-than-expected data, even this mild slowdown is unlikely to change investors' short-term expectations that the American economic situation makes a sharp interest rate cut unlikely at this time.

Jerome Powell's testimonials

Expected impact on USDBRL: bullish

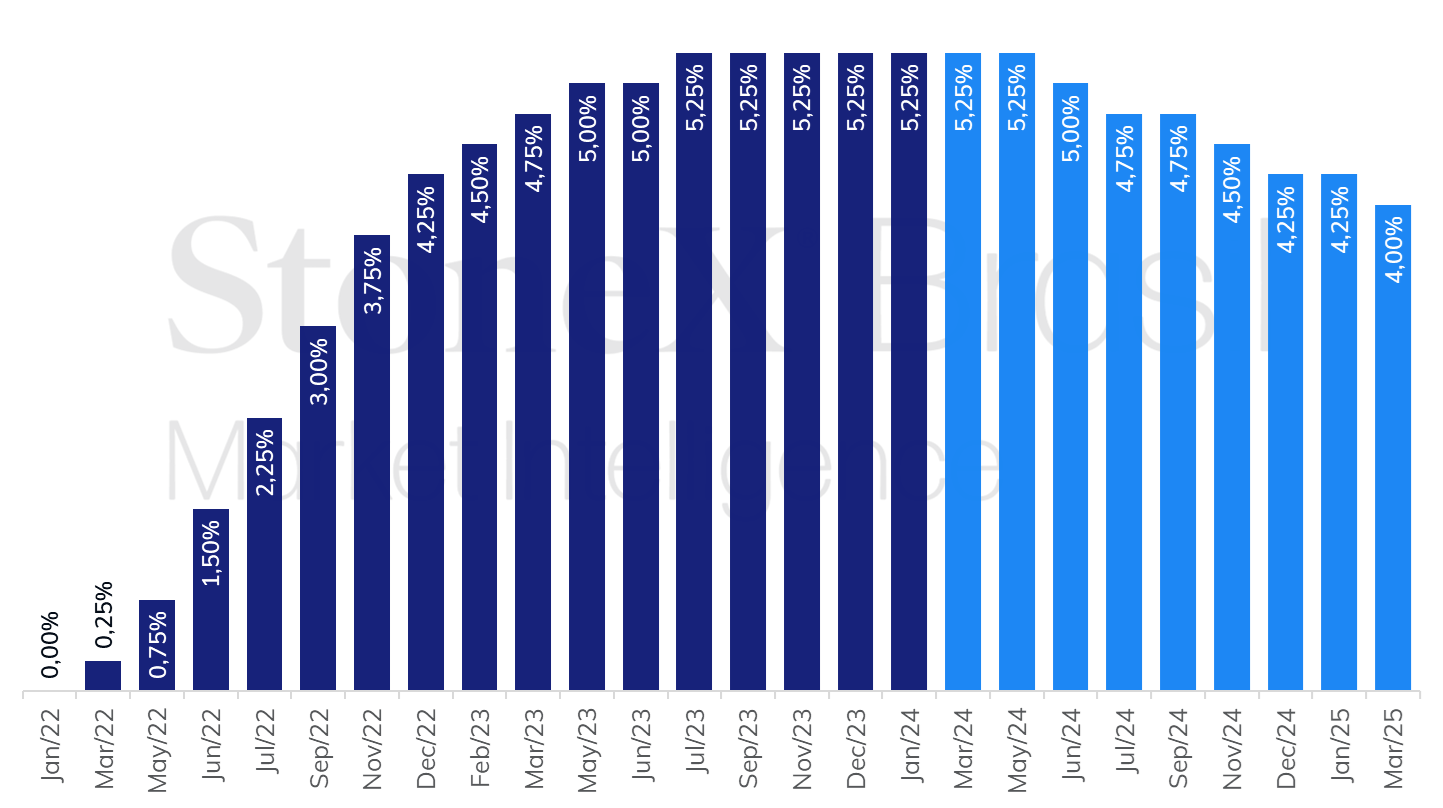

In the last few weeks, stronger statements from Federal Reserve (Fed) officials advocating caution in the conduct of American monetary policy and the release of more heated economic indicators for the country, such as job creation and consumer inflation, led to a readjustment in investors' expectations for the trajectory of US interest rates in 2024. This Friday, most bets placed in the futures market for interest rates indicated that the Fed will start its interest rate cuts cycle in June, followed by three more cuts in the year's second half. These expectations align with what the Federal Open Market Committee (FOMC) signaled in December in its Summary of Economic Projections, with a median of projections of three cuts in the year.

During his semiannual testimony to the American Congress, Fed Chairman Jerome Powell is not expected to provide much new information to financial market participants. Like other authorities within the Fed, he must recognize that there has been progress in price stabilization in recent months but insist that there is still much to be done to achieve the inflation target of 2% per year. Accordingly, Powell must reinforce the message that the central bank needs to be patient before starting an interest rate-cutting cycle and follow a careful pace in monetary easing. However, he can update legislators about how the institution is advancing its reduction in the size of its asset balance and provide insights on the pace of this "quantitative tightening" in the future.

Chinese economy data

Expected impact on USDBRL: bearish

China will release important data next week, such as the Purchasing Managers' Index (PMI) for services in February calculated by S&P Global / Caixin and the trade balance for January-February. The estimate is that the pace of service activity will increase due to the extended Lunar New Year holiday and that exports and imports have expanded. If the projections are confirmed, they can improve investors' expectations for the performance of the Chinese economy and increase the appetite for risky assets globally.

ECB monetary policy decision

Expected impact on USDBRL: bullish

The European Central Bank's monetary policy decision should keep the interest rate level and the signals for the monetary policy trajectory unchanged. Nonetheless, the meeting will be followed by the release of the central bank's macroeconomic projections, which are expected to show a deterioration in the outlook for economic growth in the eurozone and maintain estimates for core consumer inflation, which excludes volatile food and energy components. Members of the ECB also mention caution when considering the possibility of interest rate cuts at the institution, referring to wage growth data and the resilience of core prices to support keeping interest rates unchanged for some time.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.