Managing corn price risk

Let seasoned StoneX professionals design and deliver a comprehensive suite of risk management solutions to address your business needs and achieve your business goals.

Explore our services

-

Corn hedgingWe design and execute hedging programs built on proven commodity risk management principles for corn producers, consumers and merchandisers, and are not speculatively oriented. Futures and options activities are used to assist grain marketing by providing opportunities to retain margins and manage risk.

Corn hedgingWe design and execute hedging programs built on proven commodity risk management principles for corn producers, consumers and merchandisers, and are not speculatively oriented. Futures and options activities are used to assist grain marketing by providing opportunities to retain margins and manage risk. -

Equities market makingOur award-winning consultants know the futures and the physical markets. To limit risk and improve margins and bottom-line results all along the entire lumber supply chain, we’ll construct a risk-management program tailored to your needs, then work closely with you to execute it.

Equities market makingOur award-winning consultants know the futures and the physical markets. To limit risk and improve margins and bottom-line results all along the entire lumber supply chain, we’ll construct a risk-management program tailored to your needs, then work closely with you to execute it. -

StoneHedge Merchandising SystemStreamline origination. Automate offers. Simplify hedging. Our web-based merchandising system allows commercial soybean customers to automate hedging and incorporate cash bids, stream quotes, offer/order initiation and manage hedges through one easy-to-use platform.

StoneHedge Merchandising SystemStreamline origination. Automate offers. Simplify hedging. Our web-based merchandising system allows commercial soybean customers to automate hedging and incorporate cash bids, stream quotes, offer/order initiation and manage hedges through one easy-to-use platform. -

OTC productsOver the counter (OTC) products offer benefits just like exchange-traded futures. From swaps and structured products to customized and exotic options, all our OTC offerings help farmers/producers, grain elevators/originators, and food and beverage manufacturers hedge against grain market volatility.

OTC productsOver the counter (OTC) products offer benefits just like exchange-traded futures. From swaps and structured products to customized and exotic options, all our OTC offerings help farmers/producers, grain elevators/originators, and food and beverage manufacturers hedge against grain market volatility. -

Managed futuresOur managers have extensive trading and market experience, but also years spent engaged in the commodities they represent, many as farmers, growers and producers. We scrutinize statistical data to fit the right managers to a portfolio and provide reports for clients to evaluate these traders daily. Selecting a manager is ultimately the client’s choice.

Managed futuresOur managers have extensive trading and market experience, but also years spent engaged in the commodities they represent, many as farmers, growers and producers. We scrutinize statistical data to fit the right managers to a portfolio and provide reports for clients to evaluate these traders daily. Selecting a manager is ultimately the client’s choice. -

Physically traded productsStoneX offers clients financing and trade facilitation to provide working capital for commodity inventory and hedge margin. Our physical trades provide forward pricing and supply chain management services, allowing clients to manage their commodity commerce without tying up valuable resources.

Physically traded productsStoneX offers clients financing and trade facilitation to provide working capital for commodity inventory and hedge margin. Our physical trades provide forward pricing and supply chain management services, allowing clients to manage their commodity commerce without tying up valuable resources. -

Inventory financingWe offer inventory sales/repurchase, transactional finance, processing, and tolling arrangements for clients. We can also provide financing that is incremental to your established banking relationships. We aim to help clients optimize their fixed assets, such as storage facilities, terminals, pipelines, and processing facilities.

Inventory financingWe offer inventory sales/repurchase, transactional finance, processing, and tolling arrangements for clients. We can also provide financing that is incremental to your established banking relationships. We aim to help clients optimize their fixed assets, such as storage facilities, terminals, pipelines, and processing facilities. -

Derivatives marketGain access to more than 36 derivative markets worldwide across spot trading, crypto futures, interest rates, currencies, futures, options and more. With StoneX you can trade what, when and how you want.

Derivatives marketGain access to more than 36 derivative markets worldwide across spot trading, crypto futures, interest rates, currencies, futures, options and more. With StoneX you can trade what, when and how you want.

Corn solutions

At every stage of the corn production chain, participants face the risk of adverse price movements caused by a multitude of uncontrollable factors. Corn futures and options, and over the counter products provide a means to manage this risk and take advantage of potential profit opportunities.

Clearing & execution

Our suite of institutional-grade futures clearing & execution services delivers broad exchange access and transparency to clients worldwide.

Integrated Risk Management Program

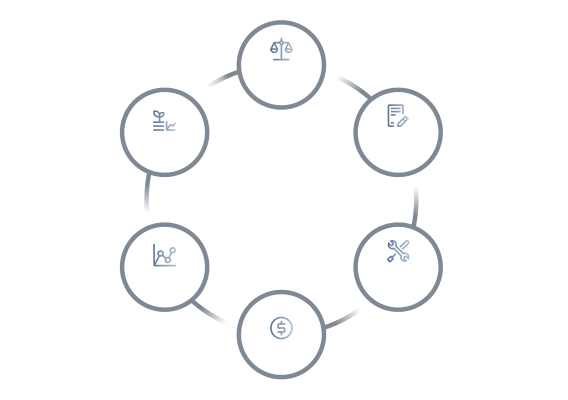

StoneX’s Integrated Risk Management Program (IRMP®) is a comprehensive, hands-on process to help companies identify their total commodity risk and develop integrated strategies to mitigate that risk. Managed by our expert consultants, the program helps companies protect their margins against price volatility and enhance their bottom line in six steps:

Consultation

Deep Analysis

Comprehensive Risk Review

Strategy Development

Implementation

Dynamic Reporting and Adjustments

Technology & clearing

We work with investors, trading advisors, custodians, portfolio accounting groups, and fund administrators to provide customized reports and files for all activity, open positions, and money balances. Dedicated Customer Service groups allow 24-hour account access via your MyStoneX portal.

Trade Allocation

Automated Average Price System

My.StoneX.com portal

Physically traded products

Inventory financing

Commodity risk management

Our award-winning consultants understand both the futures and the physical markets. To limit risk and uncertainty and improve margins and bottom-line results, we will construct a risk-management program tailored to your company's needs, then work closely with you to execute it.

Specialized foreign exchange & payments

Our capacity includes foreign exchange services to international aid and development organizations, UN agencies, NGOs, religious entities, governmental agencies, multinational corporations, and financial institutions in over 175 countries, with expertise in exotic currency payments and payments to the developing world.

StoneX risk management consultants have in-depth expertise in the supply-and-demand situation for specific commodities, access to our extensive proprietary database and detailed historical knowledge, and substantial experience creating and using innovative risk-management tools.

We've spent decades developing and designing financial solutions, tools, and platforms to help companies manage risk, meet budget restrictions and reduce market volatility. Let our specialist help you grow your bottom line.

Our clients

Our Grains and Oilseeds Group is here to advise and provide corn clients the tools and services necessary to understand risk and the risk management process. After assessing your needs and risk tolerance, we'll design a program that reflects your objectives.

Corn producers

We offer corn producers global reach, local expertise, grain marketing strategies and powerful margin-tracking tools. As one of the largest U.S.-based grain brokerage firms, we partner with producers on five continents to monitor the market and capitalize on all possible opportunities.

Food & beverage industry

All food and beverage companies face commodity price risk, but each requires unique solutions. We leverage extensive market access and deep expertise to help food processors, manufacturers and consumer packaged goods companies overcome those risks.

Corporations & cooperatives

We work with companies worldwide that originate and process corn, wheat and soybeans; grow or process sugar, coffee, dairy, lumber, and cotton; and produce energy products from crude oil or ethanol. We provide risk management, hedging, and complete marketing services to traders, processors, manufacturers' elevators, and end-users.

Boots on the Ground: Grains (US)

Visit KJA Family Farms with StoneX’s Kyle Schrad, Vice President of Global Dairy and Food Operations, FCM-Division, as he discusses how lessons learned as a boy working on his family farm inform his understanding of how a boots on the ground perspective fosters trust.

Brazil Weather Forecast

Friday 12:30 PM

Brazil Weather Forecast

Friday 12:30 PM

Perspective: Morning Commentary for April 25

Thursday 2:30 PM

Perspective: Morning Commentary for April 25

Thursday 2:30 PM

Brazil Weather Forecast

Thursday 12:30 PM

Brazil Weather Forecast

Thursday 12:30 PM

Upcoming events

FAQ

What are corn futures?

Why trade corn futures?

What industries use corn?

Why is corn traded?

How are corn futures traded?

Let’s get connected

To learn more about how our customized financial solutions can help you stay one step ahead in the global markets, contact our team today.

Select your location

The trading of commodities and derivatives such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Advisory services as well as the trading of futures and options is available through various subsidiaries of StoneX Group Inc. including but not limited to the FCM Division of StoneX Financial Inc. Public Disclosures for the FCM Division of StoneX Financial Inc. The trading of over-the-counter products or swaps is available through subsidiary StoneX Markets LLC to individuals or firms who qualify under CFTC rules as an eligible contract participant. Please click here for the full disclaimer.

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.